Are you a Lakewood Township Homeowner who had a decrease of income due to COVID, paid out-of-pocket for mental health expenses since March 2020, or who lost a spouse or tax dependent from COVID?

The LRRC is pleased to announce that it will be administering one-time grants to Lakewood Township households affected by COVID-19 to help make their mortgage payments.

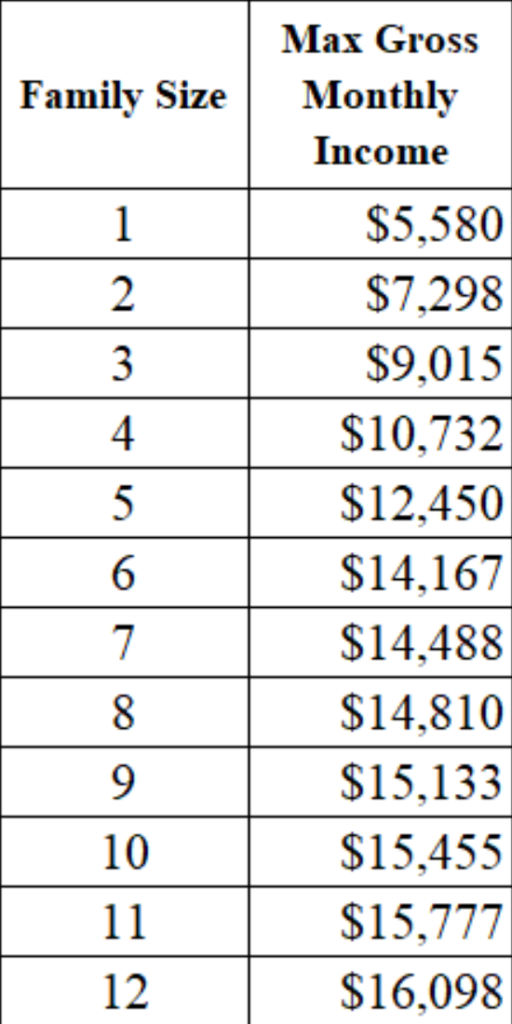

Who Qualifies: Residents of Lakewood Township who own the home they are living in and whose taxable income does not exceed the following amounts:

Income Limits

Additionally, the household must meet one of the following eligibility criteria:

- Had a decrease in income due to the COVID-19 pandemic (this program will consider taxable and non-taxable Unemployment Insurance benefits to calculate whether there was an actual loss of income). This category includes individuals laid off after March 1, 2020, and rehired for lower wages; or

- Paid out-of-pocket for a household member to receive mental health services from a licensed mental health professional from March 1, 2020, and on; or

Is a spouse or tax dependent of someone who died from COVID-19.

When: Applications are being accepted from January 27, 2022, through March 14, 2022.

How: Apply online here: http://arpam.lrrcenter.org or

Download a paper application at this link: https://bit.ly/arpamlt or

Pick up an application from the LRRC

Other Information:

Up to three months of mortgage payments will be awarded.

Completed applications with all supporting documentation must be received by 5 pm on Monday, March 14, 2022. All applications received by the deadline will be considered equally. All applications received after the deadline will not be considered. Eligibility is not a guarantee of funding.

If eligible applications exceed available funding, an independent auditor will conduct a lottery to choose which applications to award. All applications, documentation, and awards will be kept strictly confidential.

Frequently Asked Questions:

Application and Current Income:

1. I lost my job last year but managed to stay current on my mortgage payments by depleting my savings and borrowing from friends. Therefore, I am not currently behind on my mortgage payments. Do I qualify for this grant?

Yes. If you meet the eligibility criteria, you should apply even if you are up-to-date on your mortgage payments.

2. Which household members should I include on my application?

Include anyone who will be on your tax return for the current tax year.

3. I recently moved. What address should I write on my application?

Write your current address.

4. What income should I include on my application?

Include any income you are currently receiving that is taxable (i.e. part of your Adjusted Gross Income). If you are unsure whether a source of income is taxable, you should check with your accountant.

5. My current income is above the income eligibility limit. However, my income was below the income limits last year. Do I qualify for this grant?

Unfortunately, no. You must currently be under the income eligibility threshold to qualify for this assistance.

6. I am self-employed. How do I prove my current income?

Provide a profit and loss statement for last month. Alternatively, you can provide a profit and loss statement covering several months, and your average income will be used to determine eligibility.

COVID Eligibility Criteria #1 (Loss of Income):

7. I had two jobs and lost one of them due to COVID-19. I did not qualify for Unemployment Insurance benefits because of the amount I was earning even after losing my second job. Do I qualify for this grant?

Yes. You will need to show proof of the income that you lost, such as a letter from your employer that confirms how much you were earning and the date of termination.

8. I lost my job in March 2020 and was rehired in June 2020 for a lower salary. Do I qualify for this grant?

Yes. You will need to show proof that you were rehired for lower wages. Acceptable proofs include paystubs from before the termination and after the re-hiring or a letter from your employer.

9. I am self-employed and lost a significant amount of business during 2020. What can I show to prove this loss? (Updated 2/3/22)

You can provide the Schedule C from your tax return from 2019 and 2020. If 2020 shows a loss that was not covered by Unemployment Insurance benefits, you will qualify.

10. I lost my job in March 2020, but my spouse continued to work. Do I qualify for this grant?

Yes. This program will look at each individual household member to establish eligibility. If you lost income due to COVID-19, you should apply even if your spouse did not lose income.

11. I was unemployed for a couple of months during 2020 but received more money from Unemployment Insurance than I would have earned at my job. Do I qualify for this grant?

Unfortunately, no. The application asks for the amount of income lost due to COVID-19 and how much money you received from Unemployment Insurance. If your Unemployment Insurance benefit amount exceeds the amount of the income loss, you do not qualify.

COVID Eligibility Criteria #2 (Mental Health Services):

12. I paid out-of-pocket for mental health services, but I rent the home I live in. Do I qualify for this grant?

Unfortunately, no. This grant is to help cover mortgage payments for a home that you own and live in only.

13. I paid $500 to a mental health provider from March 2020 until today. I don’t plan to continue services. Do I qualify for this grant? (Updated 2/3/22)

Yes. You would qualify for a grant of up to $500.

14. I paid out-of-pocket for my child to receive ABA therapy for a mental health diagnosis. Do I qualify for this grant? (Updated 2/25/22)

You qualify with a letter from your child’s doctor confirming a mental health diagnosis. Autism Spectrum Disorder (ASD) qualifies as a mental health diagnosis for purposes of this grant.

15. I paid out-of-pocket for my child to receive Occupational Therapy. Do I qualify for this grant? (Updated 2/25/22)

Unfortunately, no. Occupational Therapy, Speech Therapy, Floor Time Therapy, and Physical Therapy are not eligible services for purposes of this grant, regardless of diagnosis.

COVID Eligibility Criteria #3 (Spouse or Tax Dependent of Someone Who Passed Away from COVID):

16. My parent passed away from COVID-19. Do I qualify for this grant?

You only qualify if you were a tax dependent of your parent in the most recent tax year. If you are an independent tax filer or file taxes jointly with your spouse, you do not qualify.

Miscellaneous Questions:

17. Will I receive the full 3 months of mortgage assistance if my income loss or payment to a mental health provider equals only 1.5 months of my mortgage? (Updated 2/3/22)

No. You will only receive the amount of the loss. For example, if you lost $1,500 and your mortgage is $1,800, you would qualify for a grant of up to $1,500.

18. What documents do I need to provide to prove my eligibility?

Please see the application for a list of required documents.

19. I received funding in the past from the LRRC’s Affordable Housing Trust Fund program. Can I apply for this grant?

Yes, as long as the grant funds will not be used to cover the same months of mortgage payments. For more information about the Affordable Housing Trust Fund program, visit: https://www.lrrcenter.org/public/special_projects/affordable_housing_trust_fund

20. I am renting the home I live in, and I am experiencing difficulty making my housing payments. Is there any assistance I can apply for?

There are three options you can look into:

Ocean County Rental Assistance Program — Opening phase 2 on January 24. For more information and to apply, visit: https://co.ocean.nj.us/OC/frmRERAP.aspx

New Jersey COVID-19 Emergency Rental Assistance Program — Accepting pre-applications now. For more information and to apply, visit: https://njdca.onlinepha.com

Lakewood Township Rental Assistance — You can reach out to Solutions to End Poverty Soon (STEPS) by calling 732.367.1640.

21. Why is this program only available for Lakewood Township residents?

This program is being funded by the Coronavirus State and Local Fiscal Recovery Funds (SLFRF), a part of the American Rescue Plan. Each Township received different amounts of money and independently decided how to use the funds they received to benefit the residents of their Township. Lakewood Township is funding this specific program. Tremendous thanks go to Mayor Ray Coles, the Lakewood Township Committeemen, and Lakewood Township’s Department of Community Development for making this program possible.